Business succession planning (BSP) is the best way for HR to ensure they retain the institutional knowledge and experience they have worked hard to accumulate in a business.

It also helps ensure your enterprise’s survival in an age where HR focusing on employee retention and quality talent is vital to business resilience.

BSP involves handing authority to lower levels of staff to avoid role gaps and ensure a successful transition for staff to leadership roles when companies lose employees through passing away, departing the company, or experiencing termination.

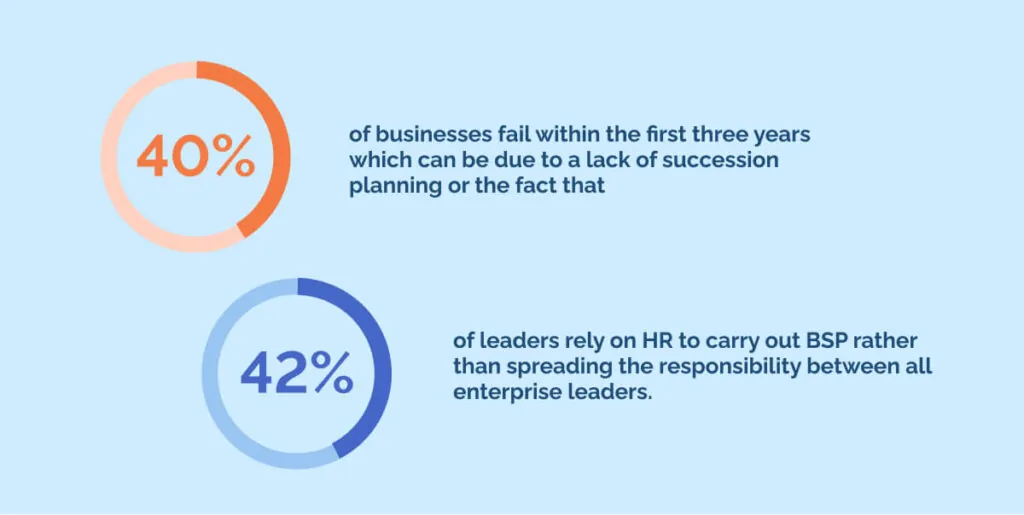

40% of businesses fail within the first three years which can be due to a lack of succession planning or the fact that 42% of leaders rely on HR to carry out BSP rather than spreading the responsibility between all enterprise leaders.

However, effective business succession planning can benefit the culture, operations and finances of any enterprise.

In this guide, we’ll explore:

- What is business succession planning?

- Why is business succession planning important?

- The 7 types of business succession planning

- Benefits of succession planning

- Barriers to business succession planning

- How leaders and HR can achieve succession planning

What is business succession planning?

Succession planning in business involves strategically transferring leadership roles from one employee or a team to another and is often a care aspect of businesses owned by multiple owners.

This business strategy aims to maintain the seamless operation of a business, ensuring continuity even when key individuals transition to new opportunities, retire, or pass away.

Additionally, it can facilitate a liquidity event, allowing the smooth transfer of ownership to emerging staff without impacting employee productivity while preserving the business’s ongoing viability.

Why is business succession planning important?

Business succession planning is crucial for continuity and yet 43% of businesses do not have a BSP plan. These businesses are missing out on an approach which can ensure a smooth transition of leadership, preserve wealth, maintain employee morale, and safeguard the company’s legacy.

Let’s go into more detail about why business succession is important to help you understand why it may benefit your organization.

Business resilience strengthening

Ensuring business resilience is paramount for sustained success, whether maintaining the current structure or navigating transitions like sales or restructuring, safeguarding assets for continual growth and prosperity.

Ensuring harmony between owners

In business partnerships, fostering harmony is essential. Balancing owner or CEO relationships within the business dynamic ensures effective operations and long-term success, nurturing a supportive and cohesive work environment.

Minimizing taxes

Minimizing estate and income taxes is a strategic goal in business succession planning. By implementing tax-efficient strategies, businesses can preserve wealth, allowing for seamless transitions and securing financial legacies.

Streamlining the retirement process

Streamlining the retirement process for the current leadership generation is a key aspect of business succession planning. Efficiencies in transitioning leadership responsibilities enable a smooth and effective handover, promoting continuity.

Control over decisions

Retaining control over decision-making processes is critical in business succession planning. By avoiding the delegation of crucial choices, businesses can ensure a strategic direction that aligns with their vision, values, and goals.

Benefits even in failure

Business succession planning remains valuable even in failure. It supports a successful transition to a new owner, offering opportunities for recovery and revitalization, ensuring that the business legacy endures despite setbacks.

Consider why BSP is important if you need to implement it in your enterprise as you consider all the reasons above.

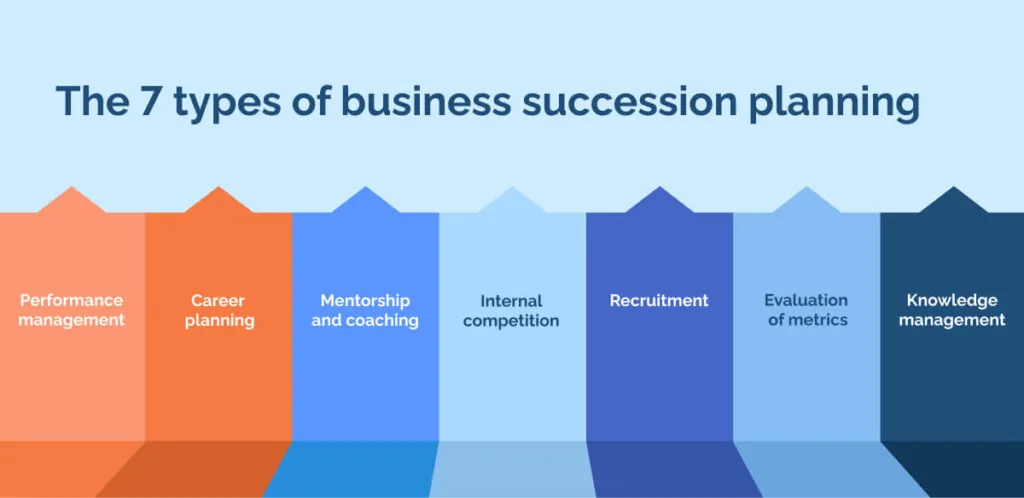

The 7 types of business succession planning

It’s challenging to understand a concept like BSP without examples, so here are some ways you might use succession planning strategies in practice.

1. Performance management

Performance management involves setting performance objectives and assessing employee performance against them.

Its primary goal is to ensure high-quality work, optimal performance, and efficient work processes.

Identifying high achievers and areas for improvement is a key outcome of performance management.

2. Career planning

Collaborative efforts between management and employees define career objectives and align them with prospects as you strategically move employees into key positions.

This process identifies employee strengths and interests, matching them with business needs. Career planning contributes to employee retention and enhances job satisfaction.

3. Mentorship and coaching

Active coaching and mentoring by managers and senior staff for employees with leadership potential assist them in gaining the necessary skills for promotion.

These programs aid personal and professional development, unlocking individuals’ full potential and preparing them for leadership roles.

4. Internal competition

Fostering internal competition among potential leaders through assigning comparable responsibilities at the same executive level.

This approach, for instance, is seen in hedge funds, where potential fund managers control portfolios of similar sizes, aiding in identifying suitable candidates for senior positions.

5. Recruitment

The success of succession plans relies on recruiting individuals capable of filling essential roles.

Developing broad sector relationships allows recruiters to swiftly fill crucial positions with external applicants, ensuring the continuous smooth operation of the organization.

6. Evaluation of metrics

Organizations assess succession planning programs through metrics such as bench strength, talent retention, leadership development, knowledge management, and competency management.

This step involves evaluating leaders’ training readiness based on competency assessments, providing insights into the reliability of succession plans.

7. Knowledge management

The capture, identification, transfer, and utilization of organizational knowledge are integral to succession planning.

Knowledge audits ensure the recording of sufficient information in specific divisions and functions, enabling future leaders to assume responsibilities in these areas seamlessly.

Benefits of succession planning

Having a formalized succession plan offers numerous advantages for both employers and employees.

Employee advantages

Employees know the potential for advancement and even ownership, fostering empowerment and increasing job satisfaction.

A plan for future opportunities reinforces employees’ commitment to career development because every staff member is a key employee in their role in the larger scale of the company.

Management and tracking advantages

Management’s dedication to succession planning results in supervisors mentoring employees to transfer knowledge and expertise.

Improved tracking of employee value enables leaders or HR to fill internal positions promptly when opportunities arise.

Improved communication

Enhanced communication between leadership and employees facilitates each business partner’s shared understanding of company values and vision.

A new generation of leaders is essential during mass workforce retirements.

Proper succession planning is particularly beneficial for public company shareholders.

Having the next CEO actively involved in business operations and well-respected long before the current CEO’s retirement ensures stability.

A well-communicated succession plan prevents investors from selling the company’s stock when the CEO retires.

Additionally, succession planning can cultivate a new generation of leaders, serving as an exit strategy for business owners looking to sell their stakes.

Barriers to business succession planning

Tax

Tax poses a significant barrier to business succession planning due to complex regulations and financial implications.

Transfer of ownership can trigger substantial tax liabilities, discouraging smooth transitions and hindering the effective implementation of succession plans.

Finances

Financial challenges hinder business succession planning, creating hurdles in funding the transition process.

Lack of resources may hinder adequate preparation, limiting the ability to address critical aspects and ensure a seamless transfer of ownership.

Legal

Legal issues pose a barrier to business succession planning by introducing complexities and uncertainties.

Ambiguous regulations, contractual disputes between owners, and compliance challenges can impede the smooth ownership transition, creating obstacles in executing succession plans.

Consider these barriers and try to integrate them within your business succession plans by liaising with finance and legal teams and explaining the barriers and urge them to consider the best way to overcome them.

How leaders and HR can achieve succession planning

More than 74% of leaders report they are unprepared and lack the training for the challenges they face in their roles. Knowing how to work with HR to achieve a business succession plan before attempting it ensures leaders’ approach is systematic and successful.

Here are seven tips to initiate the succession planning process within your company.

1. Proactively develop a plan

Leaders must work with HR to anticipate potential departures via a workforce management plan to fill gaps during planned retirements or unexpected resignations.

Leaders must assess the impact of critical roles on daily operations and consider the possible consequences of personnel changes. HR can then consider how to negate the impact of these changes in future.

To develop your plan, follow these three steps:

- Outline roles

Outline the roles, skills, and experience essential for successors (succession profiles). Seek extensive team feedback to comprehensively understand the requirements for your succession plan.

- Anticipate future needs

Anticipate your company’s future needs through a 5-year forecast. Assess organizational structure changes, turnover patterns, compensation strategies, potential retirements, and future training plans.

- Regularly revise job descriptions

Revise job descriptions based on gathered insights. Clearly communicate expectations to define suitable candidate profiles for the succession plan.

2. Identify succession candidates

HR can recognize team members capable of stepping into crucial roles. They must look beyond immediate organizational chart hierarchies and consider employees with skills conducive to higher positions.

Discovering suitable successors is pivotal in crafting an effective business succession plan. Methodically assess current talent, evaluating their skills, experience, and potential.

Consider leadership qualities, adaptability, and alignment with organizational goals. Engage in open communication with potential candidates to gauge interest and aspirations.

A meticulous identification process ensures a smooth transition, maintaining continuity and fostering the long-term success of your business.

3. Communicate the plan

Effectively communicating a business succession plan is essential for a seamless transition. Start by informing key stakeholders, such as employees, clients, and investors, about the plan’s purpose and benefits.

Use clear and transparent messaging to address concerns and ensure understanding. Implement a phased communication approach, providing updates at appropriate intervals.

Foster open dialogue to address questions and concerns, promoting a sense of stability and confidence in the transition process.

In private HR discussions, inform selected individuals that they are under consideration for roles of increasing significance.

Emphasize the absence of guarantees and acknowledge that circumstances may alter the plan.

4. Enhance professional development

Elevating professional development within your business succession plan is crucial for future leadership.

Intensify investment in the career development of chosen successors as part of workforce engagement management efforts.

Implement job rotations to broaden their knowledge and connect them with mentors to enhance soft skills like communication, empathy, and diplomacy.

Identify key skills and competencies required for successors. Implement tailored training programs, mentorship initiatives, and continuous learning opportunities.

Encourage collaboration and cross-functional experiences to broaden expertise. Regularly assess and adjust development plans to align with evolving business needs.

Prioritizing professional growth ensures a robust pipeline of capable leaders for a seamless succession.

5. Trial the plan

Test potential successors by having them assume some of the responsibilities of a manager during a vacation.

Pilot your business succession plan through a phased trial. Select a small-scale scenario, monitor its execution, gather feedback, and make adjustments accordingly. This trial ensures a smooth full-scale implementation.

Doing so provides valuable experience for the staff and allows you to identify areas requiring additional employee training.

6. Integrate with the hiring strategy

Align your hiring strategy with the business succession plan by identifying potential successors during recruitment.

Foster a culture of mentorship and skill development, ensuring a seamless leadership transition.

Identify talent gaps left by potential successors and use this information to shape future recruiting efforts.

7. Consider your succession

When crafting a succession plan, consider your eventual replacement. Identify an employee who could step into your role and initiate measures to aid their preparation for the transition.

Your workforce is dynamic, and change is the only constant when it comes to employee behaviors.

While predicting departures may be challenging, effective succession planning ensures business continuity, securing a stable future for your company using an agile approach to financial sustainability.

Implement business succession planning to ensure your survival

Implementing business succession planning is crucial for ensuring the survival and continuity of your enterprise as you keep ownership and avoid a buy-sell agreement scenario.

By identifying and nurturing future leaders, clarifying legal obligations, and addressing financial and tax considerations, senior leaders fortify their enterprise against unforeseen challenges.

This strategic approach secures your company’s legacy and fosters resilience and adaptability for sustained success for any enterprise.

Tristan Ovington

Tristan Ovington is a professional senior writer and journalist, specializing in providing expert insights on various topics such as digital adoption, digital transformation, change management, and Cloud apps. He delivers his knowledge through accessible online content that is data-driven and presented in a friendly tone, making it easy for readers to understand and implement.